Skrill vs Neteller: wallets for betting comparison

Neteller and Skrill are two of the most successful electronic wallets across the world. They are used not only for money transfers or payments, but also for depositing money into sports betting companies‘ accounts. Below you will find the main differences between Skrill vs Neteller.

Skrill and Neteller are payment products of the Paysafe Group, one of the most trusted and reliable financial institutions in the online payments industry. Although they are both from the same company and are almost similar at first glance, they’re two different digital wallets.

In this article, you’ll find the differences and similarities of these payment options so that you can be able to make the best choice for your business. The article provides details about verification, physical cards, and fee comparison and suggests the best option for sports betting if you love sports. So keep reading to discover more.

Table of content

Why do You Need an e-Wallet?

With so many markets and industries accepting different payment options, it has become important to find reliable, secure, and easy-to-use options for transferring funds. The best answer to this is the electronic wallet.

FAQ

💰 Are Skrill and Neteller the same?

Skrill and Neteller are both electronic payment systems that allow users to make online payments. However, there are some key differences between the two services. Skrill is a more traditional e-commerce company that offers a range of payment options including credit and debit cards, bank transfers, and e-wallets. Neteller, on the other hand, is an online money transfer service that allows users to send and receive money online. Both services have their own unique set of features and benefits, so it really depends on your individual needs as to which one is the better choice.

💰 Can I make transfer from Skrill to Neteller?

Skrill does not currently offer the option to directly send money from Skrill to Neteller.

💰 Can I make transfer from Neteller to Skrill?

✅ Yes, you can send money from Neteller to Skrill. To do so, you will need to log into your Neteller account and go to the ‘Money Transfer’ section. From there, you will be able to select Skrill as the recipient of the transfer and enter the amount that you wish to send.

💰 Which e-wallet has higher fees: Skrill or Neteller?

Skrill has lower fees than Neteller. However, both e-wallets have a variety of fee structures, so it’s important to compare the fees before deciding which one to use.

💰 Can I have two Skrill or Neteller accounts?

You can have multiple Skrill or Neteller accounts, but you will need to use different email addresses for each account.

💰 What is the difference between Skrill and Neteller?

One of the biggest differences between Skrill and Neteller is the fees that are charged for using the services. Skrill charges a small fee for each transaction, while Neteller does not charge any fees. Another difference is that Skrill offers a higher level of security than Neteller. Skrill uses two-factor authentication to protect your account, while Neteller only uses a single-factor authentication system.

Electronic wallets are digital payment methods that allow you to store your cash so that you can transfer funds without having to provide your sensitive information each time. And as a result, these digital wallets allow for simple and safer transactions.

Additionally, these e-wallets are accessible from anywhere and at any time, meaning you can be able to transfer funds from a device of your choice.

Verification of Skrill and Neteller

After registration, e-wallets will need to verify your identity. Skrill Neteller have the same verification process, including the requirements. To verify either your Skrill vs Neteller account, you need to have:

- Identification documents, including passport, ID card, or driver’s license.

- Mobile app or webcam for face verification.

The Paysafe Group introduced changes to its account verification process. Until recently, users could verify their Neteller or Skrill accounts by submitting photos of themselves and their ID. Also, a utility bill was among the verification requirements. But since early 2020, a utility bill is no longer used as a verification tool.

Once you submit any of the above identification documents, back, and front side, the next step is to verify your face. Keep in mind that this is a live process, meaning you must be present physically in front of your mobile phone or desktop device.

The verification process allows you to raise the limits on your Skrill or Neteller account. And that is why the procedure is thorough. The new webcam verification process requires that you take three images:

1. Holding your ID (front side) 2. Holding your ID (back side) 3. Holding a handwritten Skrill or Neteller code

At each stage of the verification webcam process, you’ll be requested to take a snapshot photo. To verify your account, you need to:

- Access the settings button in your account

- Pick the verification button

- Select verify now

- Choose your region or country

- Submit photos of your identification card

- Upload front of your identification card

- Upload back of your identification card

- Start face verification

- Neteller or Skrill will access your webcam

- Frame your face and press start

- Frame your face the second time

- Complete the process and wait for the review of your documents

Skrill vs Neteller Physical Card Comparison

Both Skrill and Neteller have prepaid cards that you can use to make purchases and withdraw funds from ATMs. They’re physical cards, and they are available free of charge.

Skrill Prepaid Card

Skrill partners with MasterCard to provide its users with a prepaid card. You can use the card anywhere MasterCard is accepted, either in person or online. You can use the card to withdraw funds from any ATM across the universe.

To get your card, there’s no credit check required, and you can be able to access your balance anytime via the Skrill app. When you order the card, you’ll get it within seven to ten days. The card allows you to set a spending limit, and it’s very secure, thanks to its unique 3D security feature.

When you purchase something online, you’ll be requested to enter a passcode that will be sent to you through your mobile phone number. To order your Skrill prepaid card, just access your account and navigate to the Skrill Prepaid Card button and press it.

Once you receive the card, you’ll need to activate it through your Skrill account online. The fees for the Skrill physical card are free for all purchases.

Neteller Prepaid Card

Similar to the Skrill prepaid card, you can use Neteller prepaid card anywhere a MasterCard is allowed. The card offers a secure payment option and provides an easy way to keep track of your transactions via the Neteller app. You can use the card to shop online or in-store, spend abroad, and withdraw funds from any ATM around the globe.

It’s simple and straightforward to apply for the Neteller prepaid card, as you only need to login into your account online and press the Net+ Card button. You can also apply through a mobile app within seconds once you install it on your device.

Once you receive your card, you’ll need to log into your Neteller account and engage the Activate button, and you’re ready to use it to make any purchases and transfer funds. There is no fee to use the Neteller prepaid card online, in shops, and in restaurants.

Neteller vs Skrill Fees Comparison

Both Neteller and Skrill make it easy to deposit, transfer and withdraw cash from your account. While the processes for transfers, withdrawals, and deposits are quick and easy for these two electronic wallets, they attract the lowest possible fees. And the good news is that all online and physical purchases do not attract any fee for both Neteller Skrill.

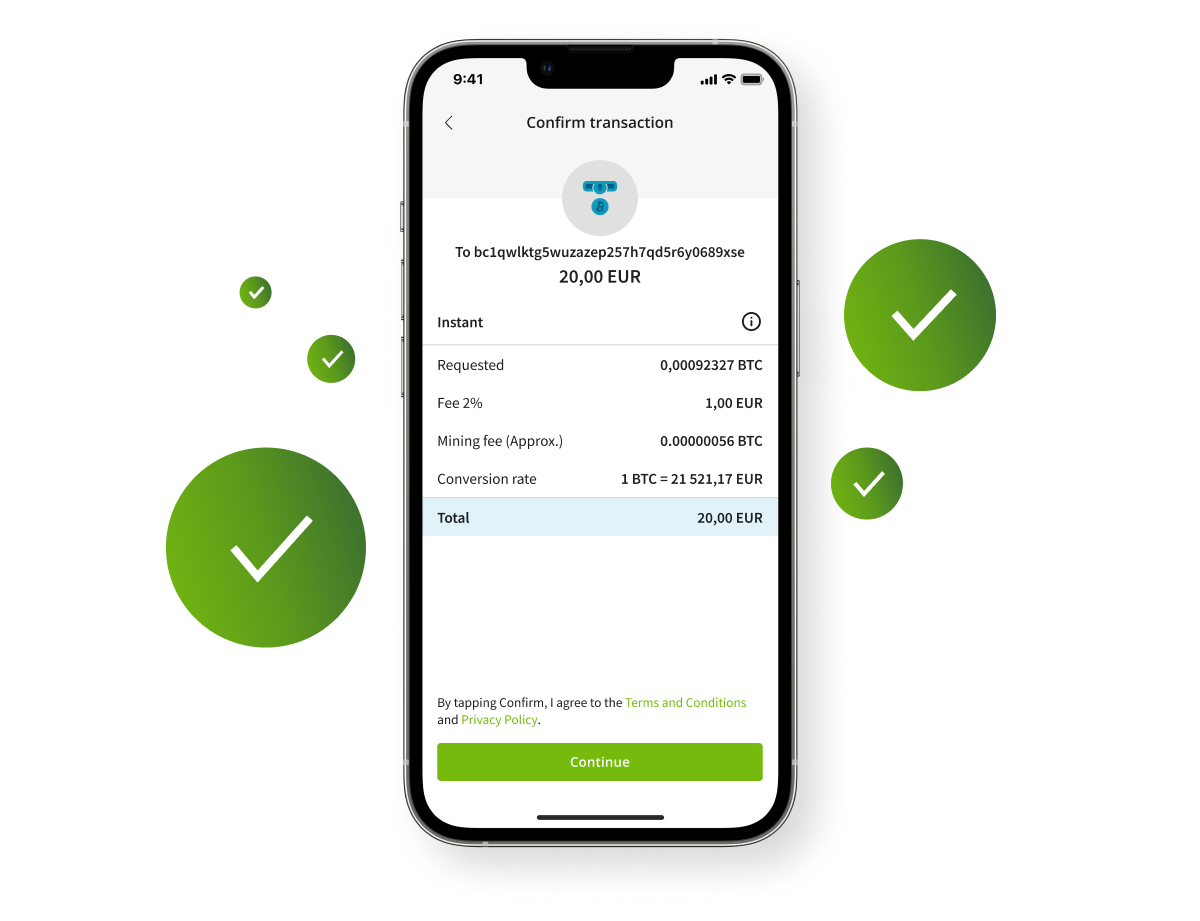

Skrill Fees

The fee for all Skrill deposits is 1 per cent of the total deposit. You can deposit from your favourite card, including PaySafeCard, American Express, Visa, and MasterCard, as well as your local bank. Be aware that there may be extra charges as a result of the currencies you use.

Skrill supports more than 40 currencies, and you can avoid FX fees when you decide to have a maximum of four currencies for your current Skrill account. Remember to keep your accounts safe since you can incur a maintenance fee of $1 after one year of inactivity.

When it comes to withdrawals, you can get your funds through credit cards, bank transfers, Skrill cards, and debit cards, among others. The withdrawal will take anywhere between 2 and 5 weekdays, and it attracts a fee. One of the cheapest withdrawal options is to use Skrill Prepaid MasterCard.

Neteller Fees

In terms of depositing funds, Neteller has many options compared to Skrill. But its fee is higher. There is a 2.5% flat fee for each deposit option which is based on the transaction. Apart from depositing from your bank, some of the options available include PaySafeCard Cash, PaySafeCard, PayByMobile, GiroPay, Maestro Debit Card, and Rapid Transfer.

Neteller users have 25 currencies to pick from. Up to four currencies are required per account/customer. A $5 monthly account maintenance fee applies if your current account isn’t active within one year.

Withdrawals through Neteller attract a fee of $12.75 and take between 3 and 5 days to process. While the withdrawal fee is higher than that of Skrill, Neteller offers the option to use the Net+ Prepaid Card or merchant sites for instant and free withdrawals.

Which is Better Skrill or Neteller for Sports Betting?

In terms of online sports betting, approximately 80% of the gaming websites worldwide accept Skrill and Neteller for deposits and withdrawals. These two payment options offer gambler-friendly services, including bonuses and promotions that result from deposits as well as free deposits.

Withdrawals from sportsbooks are almost instant for the two payment options, but Neteller attracts a little bit higher fee, making Skrill a suitable option.