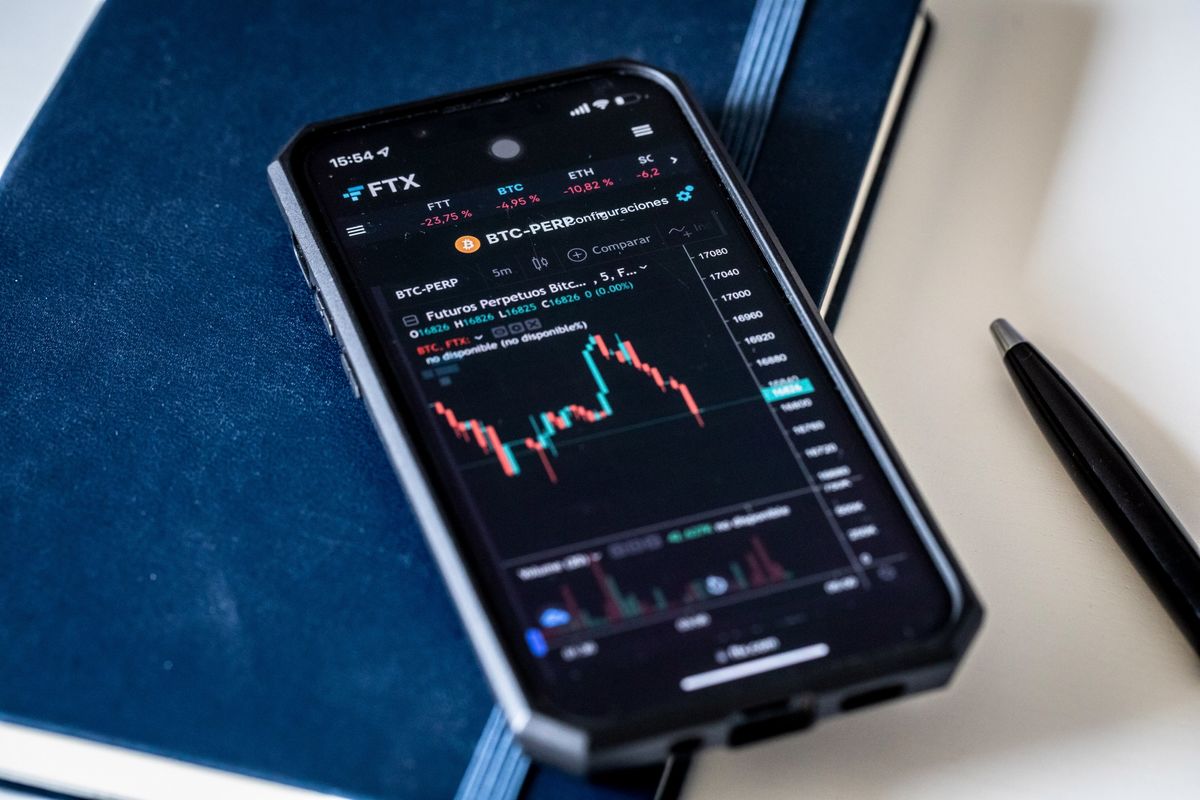

FTX Sports Betting: How exchange collapses are related to gambling?

Sports betting fans often use cryptocurrencies to place bets with online betting companies. FTX sports betting is no exception. In this article, you will learn more about the FTX exchange and its downfall.

In November 2022, massive news in the crypto sector caused an instant wave effect on some of the popular sports leagues, athletes, franchises and betting companies. FTX, a digital currency exchange that had a massive crossover into the world of sports and betting, filed for insolvency, leaving millions of investors short-changed.

Before filing for insolvency, the cryptocurrency exchange company plastered its emblem on the Mercedes Formula 1 cars (if you want to bet on Formula 1 – see the article Best Formula 1 betting sites) and uniforms of different teams in separate sports.

In a 19-year agreement worth £135 million, the home of the Miami Heat, one of the leading basketball teams in the US, was retitled the FTX Arena. On the other hand, Tom Brady, the NFL quarterback, became FTX’s ambassador.

FAQ

⭐ What is the FTX exchange?

FTX Exchange was a leading central cryptocurrency exchange. It specialized in leveraged and derivative products as well as derivatives.what happened to ftx exchange

⭐ What happened to FTX exchange?

FTX declared bankruptcy on November 11, 2022 after an increase of withdrawals from customers in the previous month. The then-CEO Bankman-Fried acknowledged that the company did not have enough assets that could meet demand from customers.

⭐ What is FTX crypto?

The FTX token is a cripto coin of the FTX exchange. Before the FTX exchange went bankrupt, it was worth $22. It then plummeted to $2.2. The future of this cryptocurrency is uncertain.

⭐ Who owns FTX exchange?

FTX exange was created by Sam Bankman Fried and Gary Wang. The CEO of the company is Sam Bankman-Fried.

In November 2022, Sam Bankman-Fried is facing various charges for defrauding customers by misappropriating their funds and making use of them to pay for Alameda Researc’s bills and expenses.

⭐ Where is FTX exchange located?

FTX crypto exchange is located in the Cayman Islands. The Cayman Islands are a British Overseas Territory located in the Caribbean Sea, south of Cuba and west of Jamaica.

If you have seen the logo of this company on the uniforms or racing cars of your favourite teams, then you can guess how its collapse can affect the sports and FTX sports betting industries. Currently, the company’s biggest problem appears to be stolen customers’ funds; however, this hasn’t been proven.

Table of content

What Happened to FTX?

FTX Exchange was one of the leading centralised crypto exchanges. In July 2021, it was the third-largest, specialising in leveraged products and derivatives. The company offered various trading products ranging from leveraged tokens and volatility products to derivatives.

The collapse of FTX occurred over a ten-day period in the first two week of November 2022. A scoop by CoinDesk, a top crypto news site, revealed that Alameda Research, a private firm run by FTX CEO, held a position valued at approximately $5 billion in FTT, the FTX native token. That prompted concerns across the digital currency industry regarding the undisclosed solvency and leverage of Bankman-Fried’s companies.

Charges against FTX’s CEO Sam Bankman-Fried

Prosecutors revealed a range of charges against the CEO of FTX. According to the Department of Justice, Bankman-Fried agreed with other individuals to defraud FTX.com customers by misappropriating their deposits and using them to pay debts and expenses of Alameda Research, a private company owned by Bankman-Fried.

In total, Sam Bankman-Fried faces more than five charges, which include the following:

- Scheme to commit wire fraud on FTX customers

- Scheme to commit wire fraud on lenders

- Scheme to commit money laundering

- Scheme to commit securities fraud

- Scheme to commit commodities fraud

- Scheme to defraud the United States and violet laws of campaign

- Federal commodities laws violations

In allegations that Bankman-Fried conspired to violate the United States campaign finance laws, the Department of Justice targeted his donations to candidates who were running for federal posts.

They are also known as SBF, and the potential penalties for the allegations against the CEO, Sam Bankman-Fried, range between hefty fines and upwards of 20 years. If found guilty of all allegations, and the verdicts run successively, Bankman-Fried could face more than 130 years in jail.

What is the Probability of Recovering Money from the Exchange?

Disgraced FTX founder, Bankman-Fried appeared in a courtroom to face federal charges, a huge step as prosecutors look for answers for what they have defined as “the scheme of epic proportions. Over one million victims remain in the primary stages of a yearlong bankruptcy court proceeding.

Most crypto traders who had deposited funds on the exchange platform fear they may never receive their hard-earned cash back. If the customers can prove that their funds were held independently from FTX’s pot of assets, the cash will be returned to them before the completion of the proceedings. However, they may not recover all of their lost assets, but they can receive anywhere between 50% and 95%.

FTX Sports Betting Relations

In the immediate outcome of the crypto exchange’s bankruptcy, various sports betting firms, including Play Up, Fanduel and BetDEX, seemed to be at a collateral damage risk.

The company had invested or planned to invest in them. The best part is that these betting companies may have side-stepped the bullet. Here are more details about them.

BetDEX

Before the bankruptcy of FTX, it was massively reported that the company acquired BetDEX. As it turns out, the investment was secured before the meltdown.

The company did not manage to buy BetDEX. It only participated in BetDEX’s seed investment round that included Lights Speed, Multicoin and Paradigm, among others.

Play UP

In 2021, the cryptocurrency exchange tried to acquire Play UP betting company for approximately $450 million. The company started negotiations in August 2021 to purchase the betting company, but the negotiations collapsed and the company did not become an FTX betting company.

The CEO of PlayUP sportsbook, Laila Mintas, was upset over her contract situation and contacted FTX’s CEO, Sam Bankman-Fried, to share some weary information about the operations of Play UP, and that is when the negotiations came to an end.

The collapse resulted in Play UP sports betting company filing a lawsuit against its CEO, accusing her of interrupting the transaction process. And the crypto exchange company’s attempt to buy this digital betting application was the second after investing in BetDEX.

Fan Duel

In 2021, FTX also tried to acquire FanDuel sportsbook. Fan Duel betting site allows punters to bet on fantasy and traditional sports. Similar to other attempts, including PlayUP sports betting company and BetDEX, the acquisition process collapsed before reaching maturity. As a result, the bankruptcy of FTX does not affect the FanDuel sports betting company in any way.

Conclusion

The cryptocurrency (for example FTX token) movement is currently unstoppable. Many banking companies have gone bankrupt before, so why should it be different in the cryptocurrency world? You must differentiate between crypto as an asset, where individuals have the decentralisation approach and the exchange platform itself.

Many countries across the world allow crypto betting, and this case will not make them go back and prevent punters from using cryptocurrencies to place bets. Gamblers will not stop using digital currencies.

They are using crypto as a payment method, not as an investment. Individuals who are likely to walk away from the crypto world are those using it as an investment. On the other hand, people who’re using crypto as a tool for sending and receiving funds will not walk away.