-

BTC $ 69320.23Bitcoin rating + 2.32%

-

ETH $ 3383.54Ethereum rating + 1.63%

-

USDT $ 1Tether USDt rating -0.01%

-

BNB $ 588.93BNB rating + 1.83%

-

SOL $ 181.12Solana rating + 3.86%

-

USDC $ 1USDC rating 0.00%

-

XRP $ 0.59XRP rating + 0.72%

-

DOGE $ 0.2Dogecoin rating + 8.48%

-

ADA $ 0.59Cardano rating + 1.49%

-

TON $ 5.38Toncoin rating + 0.28%

Bitcoin Price Prediction 2024

Bitcoin price prediction 2024 is essential for cryptocurrency users.

Bitcoin (BTC) has established itself as a prominent player in the cryptocurrency industry, garnering attention with its high prices.

Despite numerous Bitcoins predictions of its downfall, Bitcoin has consistently demonstrated its resilience and continued to dominate the market.

Bitcoin has seen a significant turnaround in 2023, and the recent price of BTC has suddenly turned. In this Bitcoin prediction, we will closely examine BTC’s prospects.

Table of content

- Top 10 Future Bitcoin Predictions by Experts

- Price Stabilization in 2024

- Current Price and Market Sentiment

- Recent Performance and Factors Influencing Bitcoin Futures Price

- Bitcoin’s History and All-Time High

- Bitcoin’s Price Fluctuations

- Other Factors to Consider

- Bitcoin’s Limitations and Challenges

- Considering Alternative Cryptocurrencies for Potential Profitability

- Forecast Bitcoin Conclusion

Top 10 Future Bitcoin Predictions by Experts

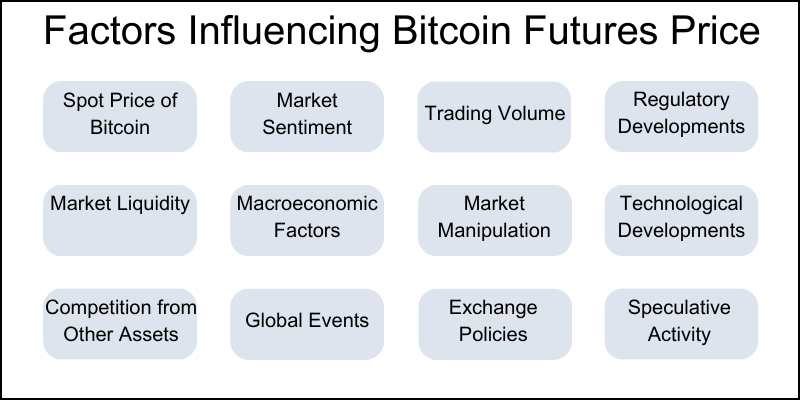

The future price of Bitcoin is highly volatile and subject to change based on various factors such as market demand, regulatory changes, and technological advancements.

Below, you can find the most prominent future of Bitcoin price predictions and reflection “will Bitcoin go up again?” :

1. Arthur Hayes’ BTC Price Prediction

A co-founder of the cryptocurrency exchange BitMEX, anticipates a potential Bitcoin rally driven by a crucial decision by the US Federal Reserve.

Hayes predictions for bitcoin is that the cryptocurrency could reach $70,000, just slightly surpassing its all-time high of $69,045, achieved in November 2021.

In a digest published on September 12, Hayes outlined his assessment, suggesting that a shift in interest rates policy by the Federal Reserve could be a significant catalyst for this surge in Bitcoin’s value.

His analysis reflects the intricate relationship between global economic policies and the cryptocurrency market.

2. Brian Armstrong’s BTC Prediction

Brian Armstrong, Coinbase’s CEO, offers vital insights into the future of digital currency. His firsthand experience with US regulations adds weight to his perspective.

Drawing parallels between initial internet skepticism and current crypto reception, Armstrong highlights how emerging tech gains widespread acceptance. This mirrors the internet’s evolution from unconventional to dominant.

Crypto’s appeal now extends beyond risk-takers, attracting a diverse audience interested in its various applications.

Armstrong, addressing regulatory challenges, sees recent legal victories as a positive for crypto.

He advocates for stricter rules for centralized entities and a more flexible approach for decentralized platforms.

He foresees a surge in crypto popularity driven by emerging applications in the first half of 2024, bringing in new investors, innovations, and opportunities as the industry matures.

3. Mike Novogratz’s BTC Predictions

Mike Novogratz, the CEO of Galaxy Digital, has undergone a shift in perspective.

Initially, Novogratz expressed strong optimism, envisioning Bitcoin surging to an impressive $500,000 by 2027.

However, the dynamic nature of the cryptocurrency market, coupled with a firm stance from both the Federal Reserve (FR) and the Securities and Exchange Commission (SEC), has prompted him to reevaluate his position.

The once enthusiastic Bitcoin forecast of $500,000 has been tempered, with Novogratz recognizing the significant challenges Bitcoin must overcome to achieve that ambitious target within his initial timeframe.

He emphasized the Federal Reserve’s aggressive measures to combat inflation as a key factor in the recent decline in Bitcoin’s value.

The cryptocurrency’s price dropped from a peak of $69,000 in November 2021 to below $16,000 in November 2022, partly due to issues with FTX. Despite the challenging period, Novogratz remains res ilient, suggesting that brighter days lie ahead.

He believes the industry will glean valuable lessons from its current trials, shrugging off setbacks and ultimately reaching unprecedented heights.

4. Pantera Capital’s Prediction Bitcoin

Pantera Capital, a prominent crypto asset management company, envisions a substantial increase in Bitcoin’s worth, approaching an impressive $148,000 in its upcoming four-year halving cycle, a viewpoint echoed in their recent “Blockchain Letter.”

The firm’s analysis underscores Bitcoin’s historical tendencies to reach cycle lows and highs at approximately equivalent intervals surrounding each halving event.

It depicts a pattern in which Bitcoin typically hits a low point about 477 days before the halving, gradually surging leading up to it and then achieving new peaks afterward, with an average duration of 480 days from the halving to the zenith of the subsequent bullish cycle.

Based on this pattern, Pantera Capital suggests that the bear market in 2022 potentially marked the nadir of the ongoing future Bitcoin price cycle. Looking ahead, they anticipate that come the next halving in April 2024, Bitcoin could possess a value of roughly $35,000.

Additionally, the subsequent 480 days post-halving could propel Bitcoin to a fresh pinnacle and conceivably to a towering valuation of around $148,000 by July 2025.

This Bitcoin price forecast is grounded in the expected decrease in new Bitcoin supply, which is anticipated to halve, potentially serving as a significant catalyst for a price surge, aligning with historical trends.

5. Tim Draper’s Bitcoin Future Price Prediction

Venture capitalist Tim Draper, an experienced figure in the crypto industry, maintains a positive outlook on BTC future.

During a recent On The Ledger podcast discussion, he reaffirmed his bold belief that Bitcoin would reach the $250,000 milestone.

While Draper initially hoped to see this achievement by June of 2023, he acknowledges that this timeline might extend further.

Nonetheless, he expressed enthusiasm, suggesting that this significant moment could align with the upcoming “halvening” event in April 2024.

While Draper does acknowledge the possibility of potential challenges, he does not envision a scenario where Bitcoin is entirely overshadowed or marginalized.

Instead, he envisions a resilient trajectory for cryptocurrencies, appearing to be undeterred by traditional financial institutions and fiat currencies, which he predicts will not impede the momentum of cryptocurrencies.

6. Cathie Wood’s Bitcoin Market prediction

Cathie Wood and her team at ARK Invest have generated considerable attention with their bold Bitcoin price prediction.

According to Cathie, Bitcoin could be poised for a substantial surge, potentially reaching an astonishing $1 million by 2030.

This Bitcoin projection is not arbitrary, as despite a tumultuous year in 2022, ARK’s recent “Big Ideas” report affirms that Bitcoin remains a resilient contender in the market.

To substantiate these assertive statements, ARK emphasizes Bitcoin’s robust network fundamentals and the increasing number of long-term holders. It’s noteworthy that Cathie has been offering price Bitcoin projections for some time now.

In 2021, she foresaw Bitcoin reaching $500,000 by 2026. As we approach 2024, many eagerly anticipate the unfolding of her ambitious BTC forecast.

7. Robert Kiyosaki’s Price Prediction Bitcoin

Renowned author and entrepreneur Robert Kiyosaki, best known for his book “Rich Dad Poor Dad,” remains a staunch advocate for including precious metals and Bitcoin in investment portfolios to safeguard against potential economic instability resulting from government actions.

Kiyosaki’s fervor for gold and Bitcoin is rooted in his belief that they are robust choices to navigate through turbulent economic periods. He envisions a sharp rise in the prices of gold and silver should the stock and bond markets experience a crash.

Moreover, in the midst of escalating global economic tensions, Kiyosaki predicts that Bitcoin could reach the significant milestone of $100,000.

During his conversation with Daniela Cambone, Kiyosaki openly expressed his skepticism towards the federal government, the Treasury, the Federal Reserve, and Wall Street, making it clear that he has limited trust in these institutions.

He advises individuals who share his sentiments to be cautious, suggesting a shift away from saving in dollars and avoiding bonds as part of a prudent financial approach.

8. Tom Lee’s Prediction

In August 2023, Tom Lee from Fundstrat presented an optimistic outlook for Bitcoin in 2024, focusing on the potential approval of the first-ever US spot Bitcoin ETF.

According to Lee’s Bitcoin price prediction, this development could propel Bitcoin to unprecedented levels, potentially surpassing the previous peak of $69,000, ranging from $150,000 to $180,000.

Lee clarified that this bullish BTC price forecast primarily hinges on the expected surge in demand, surpassing the daily supply of Bitcoin once the spot Bitcoin ETF receives regulatory approval. He suggested that this event could significantly impact the “clearing price”.

Furthermore, Lee envisions a positive future for cryptocurrency, even without ETF approval. He attributes this positivity to the upcoming Bitcoin halving event the following year.

Lee emphasized that this halving event alone has the potential to substantially increase Bitcoin’s value. However, a six-figure surge seems more plausible with the regulatory green light for the US spot ETF.

9. Standard Chartered’s Bitcoin Rate Prediction

One of the leading international banks in the United Kingdom that offers Bitcoin and crypto custody in the European Union through its subsidiary, Zodia Custody, has recently boosted its original $100,000 end-2024 forecast for Bitcoin to $120,000.

10. Heilpern’s Prediction of Bitcoin Price

Financial analyst Layah Heilpern gathered various expert forecasts for Bitcoin’s 2024 price.

Projected Bitcoin price vary widely, with Tim Draper being bullish at $250,000, JP Morgan cautious at $45,000, Cathie Wood bold at $1 million, Arthur Hayes at $70,000, and Robert Kiyosaki at $100,000.

Heilpern offers her estimate of $75,000 for 2024 but suggests the true bull market may not emerge until 2025.

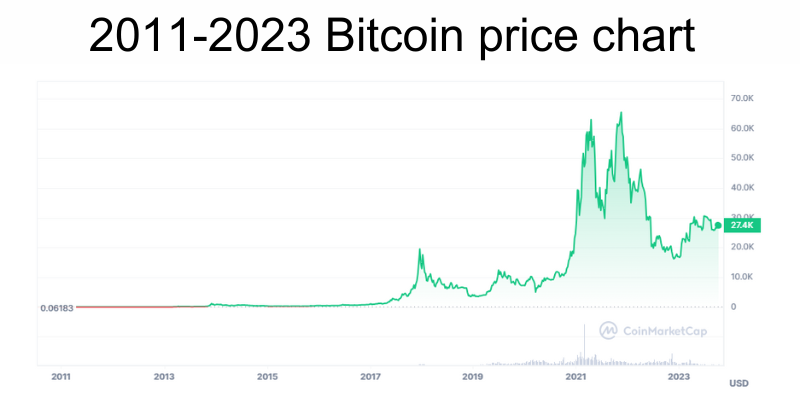

Looking back, Bitcoin peaked at $68,789.63 in 2021 but dropped significantly to $15,760 in 2022. In early 2023, it rebounded by 83%, surpassing $31,035.

However, a sudden 7.2% decline in mid-August saw it drop from $29,000 to $26,000 in less than a day. Currently, Bitcoin is around $26,632, with a prevailing bearish sentiment in the market.

FAQ

⭐ What are some key factors that experts consider when making Bitcoin future value predictions?

Making Bitcoin future prediction, experts consider factors such as adoption rates, regulatory developments, macroeconomic conditions, and market sentiment.

⭐ What are some notable Bitcoin price projections for the year 2024?

Various analysts and experts have provided Bitcoin future predictions for 2024, with some suggesting prices ranging from $50,000 to $100,000 or even higher.

⭐ How high will Bitcoin go?

Bitcoin’s future price is highly speculative and can be influenced by a wide range of factors. Some analysts and enthusiasts believe it has the potential to reach significantly higher values, possibly surpassing its previous all-time highs.

⭐ Is it possible to accurately predict the future price of Bitcoin?

No, accurately predict Bitcoin price is extremely difficult due to its inherent volatility and the multitude of factors that influence Bitcoin projected value. Bitcoin market predictions are typically based on analysis and speculation rather than certainty.

⭐ What is Bitcoin long term forecast?

Bitcoin value predictions in long term are uncertain, but many enthusiasts and analysts believe it has the potential for significant growth due to factors like increasing adoption and its store-of-value narrative.

Price Stabilization in 2024

Looking ahead to 2024, Bitcoin future price should stabilize around a support level of $21,500. This will provide a foundation for Bitcoin to slowly recover throughout the year.

Positive Trends in 2024

The macroeconomic picture for Bitcoin is expected to improve in 2024.

The anticipated cut in interest rates by the US Federal Reserve will ease pressure on the crypto market and encourage investment flows into BTC.

Additionally, draft legislation in the US that would create regulatory clarity for crypto investments could reduce uncertainty for investors.

Gradual Recovery in 2024

However, we do not expect a sudden surge in Bitcoin’s price in 2024.

The positive trends will develop gradually, and many investors may remain cautious due to the token’s failure to hold its breakout in 2023.

We anticipate that Bitcoin will gradually climb back to its support/resistance level at $25,200 in 2024.

BTC’s potential future movements are uncertain, but there are a few possibilities to consider.

One scenario is that BTC could move upwards and reclaim its 2023 high of around $31,000. However, this is unlikely to happen unless a significant catalyst pushes investors towards BTC.

Current Price and Market Sentiment

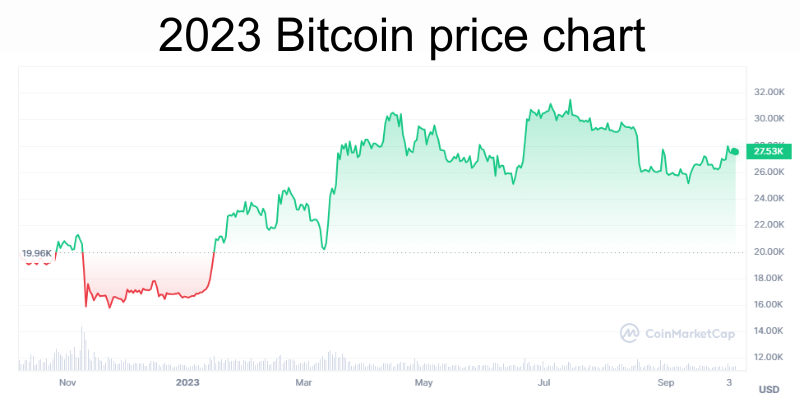

Currently, BTC is priced at $27,532, showing a 58% increase from its value of $16,605 at the beginning of the year.

The Bitcoin Fear and Greed index currently stands at 46, indicating fear, down from 55 (greed) in August. In mid-July, BTC reached nearly $32,000, almost a 100% increase from its price on January 1.

Unfortunately, this month, BTC briefly dropped to $25,000, signaling a turn in the market.

To get the best value, you should look into the best ways to buy Bitcoin.

Recent Performance and Factors Influencing Bitcoin Futures Price

Since January 2023, BTC has undergone a turnaround. By April 10, it had gained 83% year-to-date, reaching a high of $31,035.

This price also surpassed a crucial resistance level at $30,000.

From April to the end of July, Bitcoin traded around $30,000, almost touching $32,000. Positive sentiment was fueled by anticipating spot Bitcoin ETFs from major financial institutions like BlackRock and Fidelity.

On August 16 and 17, BTC experienced a sharp drop, falling from $29,000 to $26,000 within 12 hours, reaching a two-month low.

This decline represented the largest one-day drop (-7.2%) since November 2022. Some attributed this drop to a Wall Street Journal report suggesting that Elon Musk’s SpaceX had sold its Bitcoin holdings.

Another drop occurred in mid-September, although the $25,000 resistance level remained intact.

Bitcoin’s History and All-Time High

Bitcoin was the first cryptocurrency created by Satoshi Nakamoto in 2009 and introduced the concept of blockchain technology.

Initially, Bitcoin had little value but gained traction from 2013 to 2015. In 2017, Bitcoin experienced its first major boom, reaching a price of over $15,000. Subsequent booms in 2019 and 2021 led to new record highs for BTC.

Bitcoin reached its all-time high of $68,789.63 in 2021. However, it experienced a significant drop, falling to $15,760 in December 2022 during the crypto winter, influenced by macroeconomic factors such as inflation, geopolitical conflicts, and market disruptions.

Bitcoin’s Price Fluctuations

Highs and Lows in 2021-2022

Bitcoin’s price has been subject to significant fluctuations in recent years. In 2021, it reached an all-time high of $68,789.63. However, in 2022, it dropped to a low of $15,760.

Gain and Drop in 2023

In the beginning of 2023, Bitcoin experienced a gain of 83%, reaching a high of $31,035. However, it then faced a 7.2% drop in mid-August, falling from $29k to $26k in less than 24 hours. It further dipped in early September, touching $25k but not breaking resistance.

At one point, 2023 could be a breakout year for Bitcoin. The token was up 89.5%, and institutional and retail investors were interested in Bitcoin as an inflation-proof asset.

However, Bitcoin’s momentum stalled in mid-August and experienced a dramatic collapse. This was believed to be triggered by SpaceX selling off their BTC holdings. Also, increasing regulatory scrutiny and high-interest rates led investors to switch from holding BTC to holding treasury bills.

Prospects

Bitcoin’s Fear and Greed Index is at 46, indicating fear in the market. This is a significant change from July, when the index was as high as 62, indicating greed. The index considers volatility, trading volume, social media sentiment, and search trends.

Impact on Price

All of these negative developments have had an impact on Bitcoin price in the future.

It has been unable to maintain a break above the key $30,000 resistance level and has been trending downward, repeatedly testing support at $26,000.

The latest break below support is a convincing breakdown, with Bitcoin losing 5% on above-average trading volume in a day.

Other Factors to Consider

Impact of Non-Crypto News on Bitcoin Price

Non-crypto news can also affect Bitcoin’s price, as seen during the spring of 2020. Therefore, staying informed about stock Bitcoin forecasts and ecological news can provide a better understanding of Bitcoin’s current price.

News related to Bitcoin, crypto exchanges, and blockchain technology can also affect its value. Positive news about mass adoption or technological advancements tends to drive prices up, while uncertainty can cause a decline.

Varying BTC Projection

It is important to note that this information does not constitute investment advice. The accessibility of the crypto market has attracted a wide range of investors, including those with no prior trading experience.

Consequently, numerous Bitcoin price projections exist, offering varying opinions on whether its value will increase and reach expected value of Bitcoin. While some experts are bullish and anticipate a price of around $140K in the next five years, others hold less optimistic views.

The Speculation and Debate Surrounding Bitcoin’s Future Price

Bitcoin price potential is a topic of much speculation and debate.

While some experts predict a significant decline in value, others remain optimistic about its growth potential. The current state of the crypto market is complex, with new businesses embracing cryptocurrencies while regulations become increasingly stringent.

Bitcoin’s Limitations and Challenges

Unlike Ethereum or Solana, Bitcoin lacks a diverse ecosystem of crypto products and services. It functions solely as a digital currency and is hindered by its slow response to change and environmentally unfriendly proof-of-work consensus algorithm.

These factors diminish its appeal as an investment.

The Volatility and Tension in the Crypto Market

Furthermore, the crypto market is experiencing a “crypto winter,” characterized by irrational investment decisions and a tendency for holders to sell off their funds at the first sign of trouble. This volatility adds further tension to the market.

Hope for Bitcoin’s Recovery and Resurgence

Despite these challenges, there is still hope for Bitcoin’s recovery and resurgence. History has shown that Bitcoin has rebounded from previous downturns and reached new highs. Many crypto enthusiasts and experts believe that Bitcoin’s price still has the potential to soar.

Caution and Thorough Research for Bitcoin Investment

However, it is important to approach Bitcoin investment with caution and conduct thorough research. The price of Bitcoin can fluctuate wildly, and unexpected factors such as media hype or regulatory changes can greatly impact its value.

Bitcoin’s Risk and Potential as a Future Currency

While Bitcoin is considered less risky than other cryptocurrencies, it is still relatively unstable compared to traditional investment avenues like the stock market.

Fiat currencies, such as the US dollar, are generally seen as lower-risk investments, but they still carry their own level of risk. Bitcoin remains a higher-risk, higher-reward investment option for those who believe in its potential as a future currency.

The Unpredictability and Volatility of the Crypto Market

However, it is crucial to remember that the crypto market is highly unpredictable and subject to volatility. Conducting thorough research and staying informed is essential before making any investment decisions in Bitcoin or any other asset.

Considering Alternative Cryptocurrencies for Potential Profitability

While Bitcoin is considered a safe investment and the most popular cryptocurrency, it may not be the most profitable option due to its large size. Other cryptocurrencies can offer greater potential for price growth, too.

One alternative is Bitcoin Minetrix ($BTCMTX), which targets the Bitcoin cloud mining industry. This project allows users to benefit from APY yields, BTC mining rewards, and native token appreciation.

The upfront investment for Bitcoin Minetrix is only $10, making it more accessible to regular individuals. Additionally, Bitcoin Minetrix operates on the Ethereum network, known for its eco-friendly approach compared to Bitcoin’s environmental impact.

Bitcoin Minetrix has undergone a smart contract audit and is currently in its presale stage, offering a significant discount compared to the final presale stage.

The project has a total token supply of 4 billion, with 2.8 billion tokens available in the presale. Users can connect with the project through social accounts and explore the whitepaper for more information.

You can also read about other available cryptocurrencies:

Ethereum – cryptocurrency for secure, decentralized transactions and smart contracts.

Shiba Inu – cryptocurrency, inspired by a meme, with a Shiba Inu dog logo.

Forecast Bitcoin Conclusion

It’s important to acknowledge that these predictions are speculative, and there are no guarantees that Bitcoin prognose price will increase in value over any specific timeframe.

Various factors, including global economic events, interest rates, and inflation, influence the price of Bitcoin.

Bitcoin shows potential for long-term growth, so investors should consider alternative cryptocurrencies and projects like Bitcoin Minetrix for potentially higher returns.

It is crucial to conduct thorough Bitcoin price prediction research and carefully consider the risks associated with investing in cryptocurrencies.

Crypto Analyst